Introduction

Today, omnichannel strategy is no longer just about connecting online and offline channels. It is evolving to include take-back and resale programs as well. An omnichannel 2.0 is emerging that requires integrating physical store shelves, with digital platforms (digital shelf), and now online resale opportunities or what we can call the second digital shelf. In the process, brands are challenged to create a more integrated shopping ecosystem that involves engaging customers for the sale of new products as well as second and perhaps even third customers who are interested in purchasing pre-owned products.

The result is that companies now need to develop a more expansive omnichannel strategy. They can do this themselves or they can turn to specialized companies offering omnichannel 2.0 solutions across a growing number of industries. In the automotive industry, companies are developing comprehensive platforms that integrate new and used vehicle transactions across multiple channels.1 The apparel sector has similarly seen innovative solutions emerge, with brands turning to resale-as-a-service (RaaS) companies that provide dedicated resale platforms that enable trade-ins and manage pre-owned inventory.2 The electronics sector is also in the early stages of developing omnichannel 2.0 capabilities, with companies developing trade-in and device lifecycle management programs.

In short, omnichannel is going circular.

Rise of omnichannel strategy and the digital shelf

The term "omnichannel" originated in the retail and marketing industries in the early 2010s. It caught hold as a way to describe a more holistic and integrated approach to customer experience across multiple channels and touchpoints. At the same time, the word itself is a combination of "omni" (meaning all or universal) and "channel" (referring to different ways of interacting with a business), the concept developed from earlier strategies like "multichannel" marketing. The key difference is that omnichannel focuses on creating a seamless, consistent experience across all platforms - whether a customer is shopping online from a desktop or mobile device, by telephone, or in a physical store.3

The term gained significant traction around 2010-2013 as digital technologies and consumer expectations evolved. Retailers and businesses began recognizing that customers expected smooth, interconnected interactions regardless of how they chose to engage with a brand. For example, a customer might research a product online, check its availability via a mobile app, and then purchase it in-store - with the expectation of a unified experience throughout.

Omnichannel strategy plays a pivotal role in optimizing both online and offline sales by seamlessly integrating the physical shelf and the digital shelf into a cohesive customer experience. This integration creates a synergy between brick-and-mortar stores and digital platforms, enhancing overall retail performance. The physical shelf refers to traditional in-store product displays, while the digital shelf encompasses online product listings and e-commerce platforms. In an omnichannel approach, these two concepts are not viewed as separate but as complementary components of a unified retail strategy.

This integration offers numerous benefits. If done well, it should provide a seamless customer experience, improved inventory optimization, increased sales, and enhanced customer insights. By allowing customers to interact with a brand across multiple touchpoints, brands can create a cohesive shopping journey where customers can easily transition between online browsing and in-store purchases. The integration of physical and digital channels also enables more efficient stock management and the ability to fulfill orders from any location, reducing the risk of stockouts and improving overall inventory turnover. Research shows that omnichannel customers tend to spend 10-30% more than single-channel consumers, highlighting the financial benefits of this approach.4

Moreover, by collecting data across all channels, brands can gain a more comprehensive understanding of customer behavior and preferences, enabling personalized marketing efforts and targeted recommendations. To optimize this strategy, companies focus on digital shelf excellence, in-store digital integration, unified data management, and flexible fulfillment options. By effectively integrating and optimizing both the physical and digital shelf through an omnichannel strategy, companies can create a more robust and customer-centric shopping experience, ultimately driving growth and customer loyalty in an increasingly competitive retail landscape.

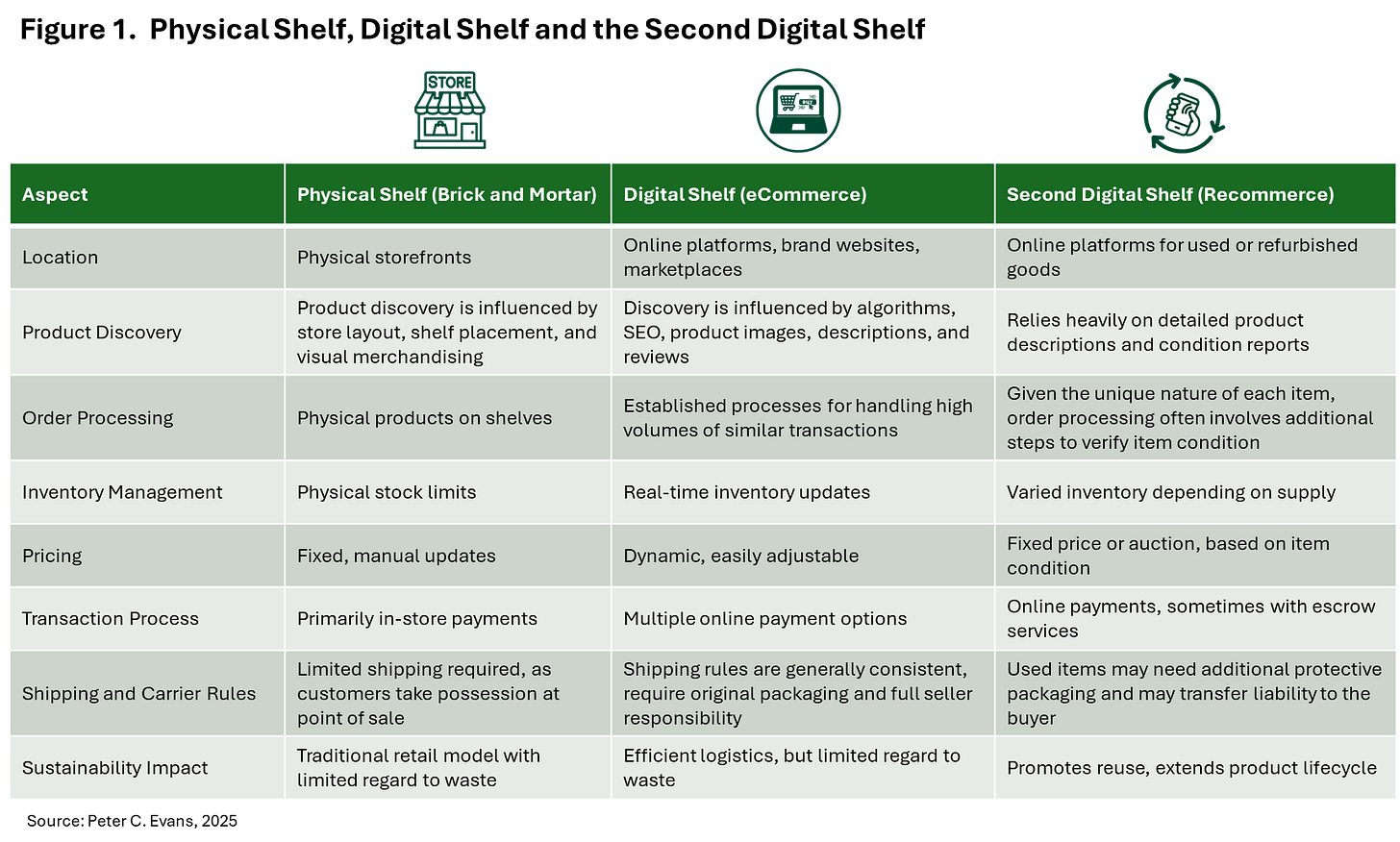

The concept of the digital shelf has become an integral part of the omnichannel movement. As consumers increasingly engage in omnichannel shopping behaviors, the digital shelf has become a critical component for brands and retailers to optimize their presence across multiple channels.5 As shown in Figure 1, we now find that omnichannel requires integrating three distinct modes of engagement: Physical Shelf, Digital Shelf, and Second Digital Shelf for recommerce. Traditional brick-and-mortar stores rely on physical storefronts where product discovery depends on store layout and visual merchandising, with fixed pricing and in-store transactions. The Digital Shelf, representing eCommerce platforms, transforms retail by leveraging online marketplaces, algorithms, and SEO for product discovery. The Second Digital Shelf then refers to all the activities associated with reverse logistics and resale of previously owned products.

Circular Economy and the second digital shelf

The second digital shelf differs from the traditional digital shelf in several key aspects. While the conventional digital shelf deals with new products, the second digital shelf extends the lifecycle of items by facilitating the resale of pre-owned goods. This distinction has consequences. One is that there are more variable pricing dynamics for used items, reflecting factors like condition and previous use, in contrast to the more standardized pricing of new items. The second digital shelf also often encompasses integrations with platforms and marketplaces specifically designed for reselling used products, returns, and refurbished items. The second digital shelf requires inventory management systems that can handle the sourcing, assessment, and listing of pre-owned items alongside new products. Quality assurance becomes a more prominent consideration, with rigorous assessment processes essential for maintaining brand reputation and customer trust in secondhand sales. While both shelves aim for seamless customer experiences, the second digital shelf may involve additional features like "buy online, return in-store" (BORIS) for both new and secondhand items.

Brands must also communicate a different value proposition for pre-owned items to customers accustomed to purchasing new products, requiring distinct marketing strategies. Technologically, the second digital shelf necessitates systems that can track and manage the lifecycle of products through multiple resales, a complexity not present in traditional new item sales. By expanding into this second digital shelf, brands can create more sustainable operations, open new revenue streams, and strengthen brand loyalty in an increasingly competitive and environmentally conscious market.

The need to consider the second digital shelf is a response to the growing market for reselling pre-owned, refurbished, or returned products through digital channels. Brands can participate in this market by either developing their own digital resale platforms or partnering with specialized service providers. By creating dedicated platforms for pre-owned items, companies can attract price-sensitive customers, enhance brand loyalty, and demonstrate commitment to sustainability. As consumers become increasingly environmentally conscious, these recommerce strategies offer a compelling value proposition that goes beyond traditional retail models.

The market for recommerce continues to expand. In 2024, the recommerce market in the United States was estimated be worth more than $200 billion. By 2030, the US recommerce market is expected to reach approximately $392 billion. These estimates are based on segments, including fashion, electronics, furniture, and luxury goods, with fashion leading the growth.6 It does not include the automotive market, which is even larger. The global used car market size is anticipated to reach USD $2.70 trillion by 2030.7 Recommerce growth reflects changing consumer attitudes towards second-hand goods and the increasing importance of sustainable consumption. For brands, mastering the second digital shelf is not just an optional strategy but an emerging necessity in a rapidly evolving retail landscape.

Enabling Omnichannel 2.0

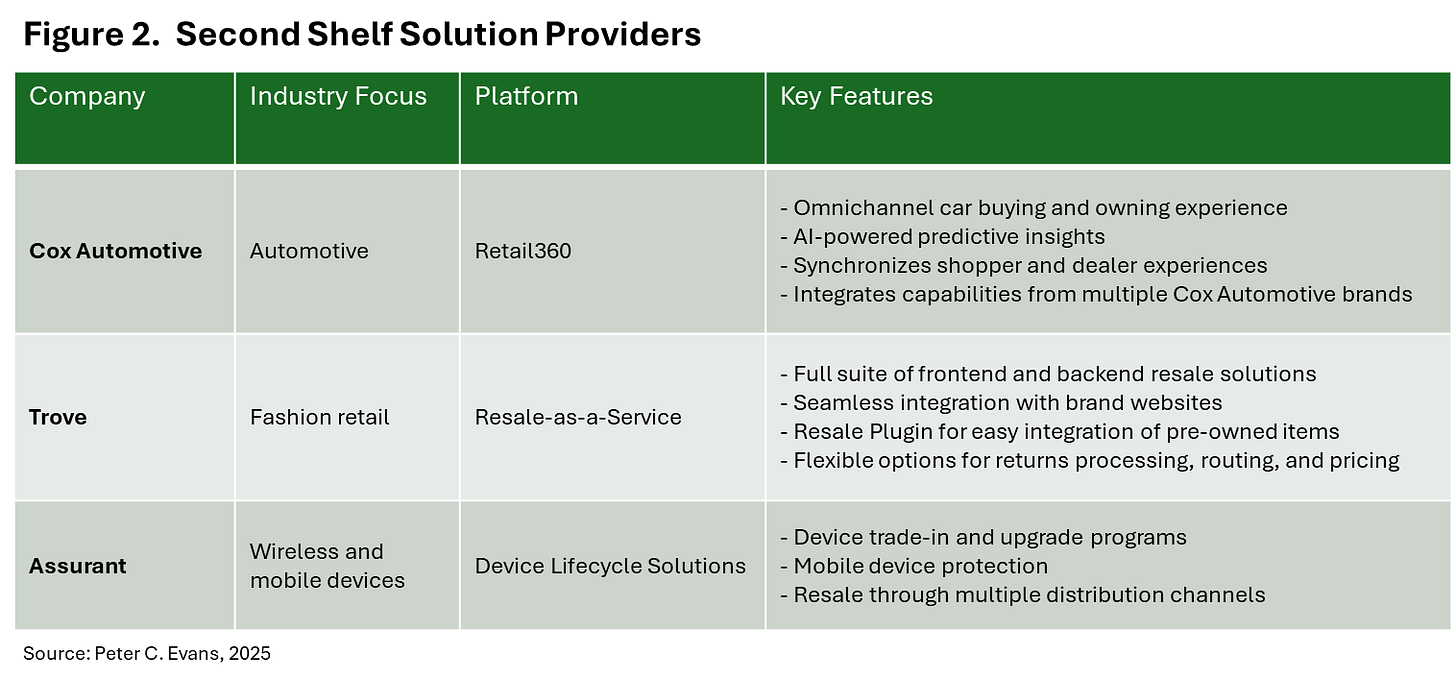

The need to embrace Omnichannel 2.0 presents brands with a critical strategic decision: they can either attempt to build the necessary infrastructure and capabilities in-house or partner with specialized companies that offer comprehensive, integrated solutions. The first option—developing second-shelf capabilities internally—requires significant investment in technology, logistics, and customer experience design. This approach allows brands to maintain full control over their resale operations but demands substantial resources and expertise that may lie outside their core competencies. Alternatively, brands can leverage the expertise of specialized companies that have emerged to support this new era of omnichannel strategy. These companies offer turnkey solutions that enable brands to quickly and efficiently enter the resale market without the need to build complex systems from scratch. While the scope and level of sophistication varies across industries, we are beginning to see more solutions become available to brands (see Figure 2).

The most advanced offerings are in the automotive industry. Take the case of Cox Automotive. In September 2024, the company introduced Retail360, a comprehensive suite of tools designed to enable a true omnichannel experience for the automotive industry. This service is focused on both new and used car purchases.8 It consists of a platform designed to provide a comprehensive omnichannel experience for the entire auto retail ecosystem, encompassing all stages of the car-buying and owning journey. Retail360 integrates capabilities from various Cox Automotive brands, including Autotrader and Kelley Blue Book, which are known for both new and used vehicle listings. The platform aims to modernize and streamline the automotive retail experience for all types of vehicle transactions. It connects dealer websites, third-party marketplaces, and showroom experiences, allowing for a seamless process whether a customer is interested in a new or used vehicle. The focus is on creating a unified, personalized experience for car buyers and sellers across the entire automotive retail spectrum, rather than limiting itself to either new or used vehicles exclusively.

In the apparel sector, Trove offers a full suite of services to help fashion brands enter and grow in the resale market. Their offering includes frontend and backend solutions, software integration with brand websites and Shopify, customizable backend support, and an omnichannel resale experience with in-store and digital trade-ins. Trove has partnered with numerous major brands and claims to hold over 75% of U.S. branded resale traffic. Trove's acquisition of Recurate enhanced its capabilities in inventory management for branded resale programs. This acquisition, which took place on August 13, 2024, improves Trove's inventory management capabilities by enhancing non-new inventory handling, expanding the operational network, and adding Shopify integrations for seamless inventory management.9 It also brings peer-to-peer expertise to Trove's offering, providing an additional channel for inventory sourcing and management.

The combined technologies enable brands to launch resale programs in as little as four weeks, allowing for quicker implementation of inventory management systems. These improvements position Trove to better serve brands in managing their resale inventory across multiple channels, from in-store and digital trade-ins to peer-to-peer transactions, ultimately streamlining the entire resale process. As a result of this acquisition, Trove now commands over two-thirds of total U.S. branded resale traffic, cementing its status as the market leader in apparel resale solutions.10

Electronics represents another sector witnessing the emergence of early omnichannel 2.0 resale strategies. Companies like Assurant are playing a role in creating more integrated solutions for telecom companies and smartphone manufacturers. Assurant has developed device trade-in and lifecycle management solutions that span multiple channels and address key market needs. By providing carrier-grade wireless device trade-in programs, Assurant enables consumers to receive instant, in-store credit for their used devices, creating a seamless upgrade experience. Their global network, which encompasses nearly 20,000 retail locations, allows for an interconnected approach to device resale. The company offers end-to-end solutions that include point-of-sale software with advanced analytics, device processing, and refurbishment, secure data removal, and access to secondary markets for resold devices. While not yet as comprehensive as resale platforms in the automotive or apparel sectors, Assurant represents a critical step towards a more integrated omnichannel approach in electronics resale for mobile devices.

Conclusion

Omnichannel strategy is evolving beyond traditional online and offline integration to embrace a circular approach that includes recommerce. The emergence of the "second digital shelf" represents a strategic imperative for businesses across industries like automotive, apparel, and electronics. By integrating new product sales, digital platforms, and resale opportunities, brands can:

Create more sustainable and environmentally conscious business models

Open new revenue streams

Attract price-sensitive customers

Strengthen brand loyalty

As consumer attitudes and the regulatory environment shift towards sustainable consumption and circular economy principles, mastering the second digital shelf is no longer optional but a critical competitive advantage in the evolving retail landscape. The "second digital shelf" is becoming as fundamental to brand operations as the physical shelf and the digital shelf.

Footnotes