Introduction

Smartphones have become essential tools in our daily lives, seamlessly enabling how we work, entertain ourselves, and interact with others. With over 1.34 billion devices sold globally in 2022 alone, the question of what happens to these phones after their initial use is increasingly critical.1 Despite the significant number of smartphones re-entering the market, a staggering number remain outside formal recovery programs, leaving hundreds of millions of devices unaccounted for in resale and recycling. This is not a new phenomenon, and the cumulative effect of this problem is mounting at a truly mind-blowing rate. The good news is this is an inherently solvable problem and one that has solutions to turn the tide.

In this article, we explore the current state of smartphone recycling and refurbishment, highlighting the roles played by manufacturers, telecom carriers, and online marketplaces in promoting a circular economy. We highlight the urgent need for improved takeback programs, consumer incentives, and enhanced data on device compatibility to increase the number of phones processed through formal channels and reduce electronic waste.

Mapping the Flow of Phones

Smartphones have become deeply embedded in how we work, play, and interact by serving as all-in-one devices that blend our personal and professional lives. These increasingly powerful pocket-sized computers allow us to stay connected 24/7, enabling instant communication through calls, texts, emails, and social media apps. In the workplace, smartphones facilitate remote work, on-the-go productivity, and constant accessibility to colleagues and information. For leisure, they provide entertainment through games, streaming services, and social platforms. Smartphones have also transformed how we interact socially, allowing us to maintain relationships across distances and share experiences in real time. Their ubiquity and versatility have made them indispensable tools for navigation, shopping, banking, health tracking, and countless other daily activities.

As important as we perceive these devices to be in our lives in the developed world, they play an even larger role in the developing world, where they help connect people with financial services, healthcare and generally bring efficiencies to economies where time savings enable people to be more productive. You can see that the GDPs of these economies have improved as smartphones have permeated everyday activities.

Not surprisingly, a massive number of phones are bought and sold every year. In 2022, manufacturers like Samsung, Apple, and Oppo, collectively shipped 1.2 billion phones. Another 183.3 million came onto the market from pre-owned phones that were refurbished and prepared for resale. This brings the total number of phones sold worldwide in 2022 to 1.34 billion.2

Figure 1. Flow of Smart 1.34 billion Smart Phones in 2022

What happens to all these phones? Surveys suggest that most consumers keep their phones for 2 to 3 years before replacing them. After that, the data becomes murkier as there are wide variances by country and income levels. Based on available survey data, we estimate that 310 million phones entered formal takeback programs offered either by manufacturers, carriers, or third parties specializing in the secondary market for phones. This represents less than a quarter of all the phones sold, or 23 percent.

Among the roughly one quarter of the phones that consumer channel to taken-back programs, 80 percent undergo a comprehensive process to ensure the devices are secure, functional, and attractive to buyers. The other 20 percent deemed to be nonfunctional are funneled to recycling operations. This begins with shredding them into smaller pieces, making the materials easier to handle and process. After shredding, the resulting pieces are sorted based on their composition, allowing different types of materials like metals and plastics to be collected.

The next step often involves melting down or smelting these sorted materials to extract valuable components. Current technologies can reclaim up to 80% of the materials used in cell phones, including a wide range of valuable metals. Precious metals like gold, silver, platinum, and palladium can be extracted, along with base metals such as copper. Some rare earth elements used in magnets, like neodymium, are also recoverable, as are other metals including cobalt, lithium, nickel, and tungsten. To put this into perspective, for every million recycled smartphones, it is possible to recover over 35,000 pounds of copper, 772 pounds of silver, 75 pounds of gold, and 33 pounds of palladium.3

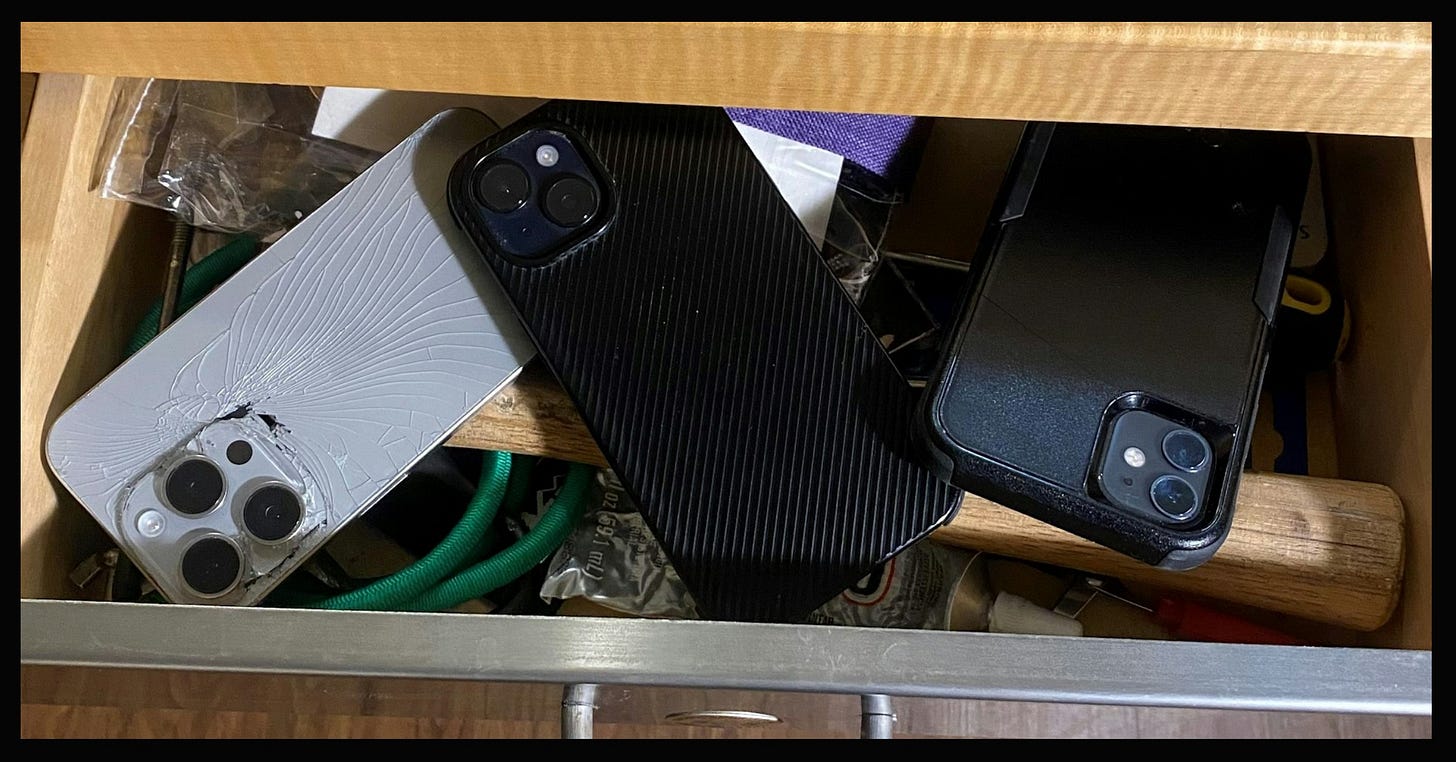

If slightly less than a quarter of the smartphones are resold or properly recycled, what happens to the rest? Some are discarded in the trash. This amounts to around 8 percent or 82.3 million devices annually. However, the majority of the phones that do not go through formal takeback programs, or approximately 950 million, are kept by consumers in drawers, closets or other locations where they lay dormant. Surveys suggest a variety of motivations.4 Some keep them as a backup, others are kept out of concern around data privacy, not trusting the data on the phones will be removed if they are traded in. Others keep them out of lack of awareness regarding formal trade-in or take-back programs. Some pass them on to relatives or friends. A few even keep them for sentimental reasons. The result is that hundreds of millions of phones that could be resold or recycled are not.

This flow of phones, or lack thereof, has to be fixed. It is a profoundly wasteful situation, with important negative economic and environmental consequences.

Manufacturers

Initially, smartphone manufacturers played little role in creating a more circular economy for phones. However, this has begun to change. Many major manufacturers, including Apple, Samsung, and Oppo, have established trade-in and buyback programs to encourage customers to return their old devices in exchange for credit towards new purchases or gift cards. These programs serve as a vital first step in recapturing devices that might otherwise stay in drawers or end up in landfills. Once collected, suitable devices are refurbished and resold through programs like Apple's Certified Refurbished and Samsung's Re-Newed programs, offering like-new devices at reduced prices and extending their useful lives. For devices that cannot be refurbished, manufacturers operate recycling initiatives to recover valuable materials, including parts harvesting, and metals reclamation.

Manufacturers are also increasingly designing phones with circularity in mind Apple is increasing its use of recycled materials in new iPhones and reducing packaging waste. Samsung has introduced more easily repairable designs in some models. Apple has made a significant advancement in smartphone repairability with a new electrically induced battery removal process for the iPhone 16 and iPhone 16 Plus models. This innovative approach uses a type of adhesive that can be loosened with low-voltage electrical current, such as from a 9V battery, making it easier to remove the battery compared to the adhesive pull tabs found in some previous iPhone models.5 While not eliminating adhesives, this approach provides a more controlled and potentially less damaging method for battery removal, which could make repairs and battery replacements easier for both professionals and potentially end-users.

However, challenges remain in improving collection rates, enhancing repairability, and expanding refurbishment capabilities. Many old phones still do not make it back to manufacturers, and some designs continue to prioritize sleekness over ease of repair.

Telecom carriers

Telecom carriers have developed various programs aimed at device collection, refurbishment, and resale. Major carriers like Verizon, AT&T, T-Mobile, and Vodafone have implemented trade-in and buyback programs to encourage customers to return their old devices in exchange for credit toward new purchases or bill credits. These programs serve as a crucial first step in recapturing devices that might otherwise not follow a circular path.

After collection, carriers refurbish suitable devices for resale, with companies like Verizon and AT&T offering certified pre-owned devices at discounted prices compared to new models. Vodafone has also implemented trade-in and refurbishment programs in various markets, promoting the sale of pre-owned devices. For devices that cannot be refurbished, many carriers partner with certified e-waste recyclers to ensure proper disposal and material recovery from unusable devices, with some establishing their own recycling facilities or partnerships to handle end-of-life devices.

Despite these efforts, carriers face several challenges in creating a more circular economy for phones. Improving collection rates remains a significant issue, as many old phones still don't make it back to carriers or recycling programs. Enhancing refurbishment capabilities to increase the proportion of collected devices that can be refurbished and resold is another area for improvement. Consumer education also plays a crucial role, with carriers working to raise awareness about the importance of device recycling and trade-in programs.

In China, for example, the recycling rate for mobile phones remains low, with only an estimated 5.2% of used phones entering identified recovery channels.6 This presents a significant opportunity for carriers like China Mobile to expand their recycling efforts in the world's largest smartphone market. As environmental concerns grow and regulations tighten, carriers are likely to expand these circular economy initiatives further, potentially leading to more comprehensive take-back programs and increased focus on device longevity and repairability.

Online marketplaces

Online marketplaces have come to play a growing role in fostering a more circular economy for smartphones by facilitating the buying and selling of pre-owned devices. Platforms like BackMarket, Reebelo, Valyuu, Northladder, Cashify, Carousell, and Mercari act as intermediaries between sellers looking to dispose of their old phones and buyers seeking affordable, refurbished devices. As illustrated in Figure 2, there are now 45 platforms, wholesale and retail, that support the trade in secondary phones. These marketplaces contribute to the circular economy in various ways, including extending device lifespans, providing affordable options, encouraging recycling, raising awareness about sustainable consumption, supporting local economies, and driving innovation in refurbishment processes.

These marketplaces have made significant strides in promoting a circular economy for smartphones, but challenges remain. Building consumer trust in refurbished devices, standardizing quality assessments across the industry, and competing with the allure of new device releases are ongoing issues. However, as environmental concerns grow and the quality of refurbished devices improves, these platforms are likely to play an increasingly important role in the smartphone ecosystem. By keeping devices in use for longer, reducing electronic waste, and making technology more accessible through affordable options, these marketplaces are instrumental in shifting consumer behavior towards more sustainable practices. Their efforts in partnering with recycling facilities for proper e-waste management and educating consumers about the benefits of buying and selling used devices further contribute to promoting more sustainable consumption habits in the smartphone industry.

Figure 2. Platforms Trading Preowned Smartphones: Wholesale and Retail Marketplaces

Online marketplaces for pre-owned smartphones both complement and compete with smartphone manufacturers and telecom carriers in creating a more circular economy for phones. These platforms complement the industry by extending product lifecycles, aligning with manufacturers' and carriers' sustainability goals. They provide additional channels for brand exposure, offer valuable market insights, and support trade-in values, benefiting both manufacturers' and carriers' trade-in programs. However, these marketplaces also introduce competitive elements. By offering more affordable pre-owned options, they can divert consumers from purchasing new devices and compete with manufacturers' and carriers' own refurbishment and resale programs. This competition extends to customer relationships, and data collection, and potentially exerts downward pressure on new device prices.

These platforms fill a crucial role in the ecosystem by providing efficient mechanisms for device resale and recycling, which supports the broader goals of reducing electronic waste and promoting sustainable consumption patterns in the smartphone industry. They help maintain a robust secondary market, which is essential for the overall health and sustainability of the smartphone ecosystem. As the industry continues to evolve towards more circular economic models, the interplay between these various stakeholders will likely become increasingly important in shaping the future of smartphone consumption and disposal patterns.

Doubling the Circular Economy for Phones

To double the number of phones processed through formal channels from 310 million to 620 million, would require contributions from multiple stakeholders. A goal of this magnitude would necessitate a combination of improved takeback programs, consumer education, financial incentives, and regulatory measures. Manufacturers and telecom carriers need to expand and enhance their trade-in and buyback programs, making them more accessible and attractive to consumers. Simultaneously, comprehensive awareness campaigns should be launched to educate the public about the opportunities to reuse and recycle smartphones. Financial incentives, such as more attractive trade-in values or deposit-refund systems, could significantly boost participation.

Governments could play a crucial role by introducing or strengthening regulations, implementing extended producer responsibility programs, and banning e-waste disposal in landfills. Technological solutions, like user-friendly recycling apps, could increase transparency and convenience in the recycling process. Investing in improved refurbishment and repair infrastructure, along with supporting right-to-repair initiatives, will be essential to handle the increased volume of devices.

Corporate partnerships between manufacturers, carriers, and third-party recyclers could create more efficient and widespread collection networks. Encouraging manufacturers to design phones with circularity in mind would facilitate easier repair and recycling. Expanding recommerce channels and ensuring robust data security measures would further support the growth of the secondary market. Global coordination, including the development of international standards for e-waste recycling, would ensure consistent practices across borders.

The GSMA (Groupe Spécial Mobile Association) is an industry organization that represents the interests of mobile network operators worldwide. In 2023, the GSMA announced new circularity targets on takeback and zero waste with12 leading global carriers.7 The commitment to increase the number of phones they take back is a step in the right direction, but more ambitious targets and broader industry participation would be needed to achieve a global doubling goal.

More attention and creative ideas are needed to overcome the factors causing consumers to keep phones despite no longer being used. A number of behavioral factors play into these behaviors. Some of the motivations include status quo bias, loss aversion, and the endowment effect. People tend to prefer the current situation, resist change, and overvalue items they own, making it difficult to part with old phones. Present bias and choice overload also play roles, as individuals prioritize immediate convenience over future benefits and may feel overwhelmed by the various options for recycling or trading in their devices.

Other factors contributing to this behavior include procrastination, information asymmetry, privacy concerns, the sunk cost fallacy, and emotional attachment. The lack of urgency in dealing with unused phones, combined with limited awareness of e-waste impacts and recycling value, often leads to the indefinite postponement of action. Fear of data breaches, the memory of the phone's original cost, and the sentimental value attached to personal memories stored on the device further complicate the decision to recycle or trade in old smartphones.

How Better Data Can Help

Better information regarding device compatibility in advancing a more circular economy for smartphones is also essential. Enhanced device compatibility information would play an important role in reducing risks for consumers of pre-owned phones and improving the matching of phones with the locations where they will work effectively. This is particularly critical for Android devices, as they have myriad more radio/modem variations that disrupt activation on networks when they are redistributed globally for reuse. Solutions for this exist but are only starting to be applied in the reverse supply chain to improve reuse as an outcome.

This improved information flow could significantly contribute to doubling the number of used phones processed through formal channels. By providing clear, reliable information about compatibility with preferred carriers and networks, consumers would be more confident in buying pre-owned devices, potentially increasing demand and driving up the number of phones processed through formal channels.

Better compatibility information would allow users to purchase devices that work across different countries and networks, expanding the global market for used devices. Detailed compatibility data for specific network bands and technologies would help users make more informed decisions, potentially increasing the value and desirability of certain pre-owned models. This could lead to fewer returns and greater satisfaction with pre-owned devices, as well as support emerging markets where network technologies differ. Enhanced compatibility information could also improve trade-in programs and refurbishment targeting while contributing to broader consumer education efforts about the value and viability of pre-owned devices.

Tools like enhanced IMEI checkers, global compatibility databases, standardized compatibility reporting, and integration with e-commerce platforms could all help improve the availability and accuracy of device compatibility information. By reducing barriers to the adoption of pre-owned devices, these improvements could significantly contribute to the goal of doubling the number of used phones processed through formal channels, benefiting consumers and supporting the growth of a more circular and sustainable smartphone economy.

Conclusion

While progress has been made by manufacturers, telecom carriers, and online marketplaces in fostering device recycling and refurbishment, much greater effort is needed. The number of smartphones processed through formal channels should double over the next five years. Hundreds of millions of phones that could be resold or recycled remain outside formal recovery programs.

Ultimately, the transition to a truly circular economy for smartphones demands new creative ideas. The current system is not circular enough. Smartphone manufacturers, carriers, and the growing number of third-party platforms, each have a role to play. New approaches are needed. Doubling the number of phones that flow through official take-back programs is ambitious but it can be done.

Let’s get to work!!

About the Authors:

Peter C. Evans is a globally recognized expert on digital platforms and corporate strategy with over 20 years of experience in the field. He supports clients around the world navigate the evolving landscape of e-commerce and digital marketplaces with a recent focus on circular platforms. As a prolific writer, Evans regularly contributes to publications like Forbes and Circular., sharing his expertise on platform strategy, digital transformation, and emerging technologies. Evans holds a PhD from the Massachusetts Institute of Technology (MIT), where he also co-chairs the MIT Platform Strategy Summit.

Seth Heine is a prominent entrepreneur and the Chairman and Co-Founder of PrologMobile, a leading Data-as-a-Service platform for mobile devices. With over 20 years of experience in the technology sector, Heine has successfully launched several companies, including Mobile Capital Management and ecoATM. Heine is also recognized for his commitment to sustainability; he was instrumental in developing the R2 environmental protocols aimed at reducing the carbon footprint associated with electronic devices.

Footnotes

https://www.statista.com/statistics/263437/global-smartphone-sales-to-end-users-since-2007/#:~:text=In%202022%2C%20smartphone%20vendors%20sold,to%201.34%20billion%20in%202023.

https://www.statista.com/statistics/263437/global-smartphone-sales-to-end-users-since-2007/

https://www.epa.gov/archive/epapages/newsroom_archive/newsreleases/2f0711847e1f1c18852576f80053f5fd.html

https://journals.sagepub.com/doi/pdf/10.1177/0734242X221105429

https://www.weforum.org/stories/2022/11/cop-27-china-build-circular-economy-mobile-phones/