Maximizing Value in Secondary Markets: A Multi-Tiered, Multi-Platform Approach

Brands and OEMs may focus on selling new products, but they must also deal with returned products. Returns come in many forms and happen for various reasons.1 Some returns are due to things companies try to avoid, such as overstock, undelivered orders, buyer’s remorse, and warranty returns. Others are intentional, like returns from ending leases, early upgrades, and trade-in programs that companies encourage. Additionally, returns may come back due to regulatory mandates that require responsible disposal. As a result, a steady stream of products comes back to companies for different reasons and in varying conditions. Whether wanted or unwanted, these returns must be managed.

Developing strategies to triage returns and sell those that have value in secondary markets can greatly boost a company’s profits. However, getting the most value in secondary markets can be a challenge. It takes a multifaceted approach, selling through multiple channels to reach different customer groups. Companies must balance pricing, protect their brand reputation, and efficiently clear inventory, which means setting the right sales pace. This requires creating new business processes, using new software tools, and managing a different customer experience. This article explores how to leverage secondary markets using a multi-tiered, multi-platform strategy.

Specialized Capabilities

To maximize value in secondary markets, brands and OEMs need specialized capabilities that go beyond what’s required for primary sales. Companies need to develop the ability to evaluate their return streams to identify recovery opportunities.2 This involves analyzing the types, volumes, and conditions of returned items to determine their potential for reuse, resale, repair, or recycling. A triage system should be implemented to efficiently route returns to appropriate channels such as restocking, refurbishment, recycling, or disposal. Optimizing warehouse layouts and dedicating specific areas for returns processing helps handle returns more efficiently.

After asset recovery and processing, companies need to build value recovery strategies that tap into resale opportunities. The secondary market is complex. To win buyers, it is necessary to provide accurate grading, detailed descriptions, and thorough documentation of refurbished items. Clear item histories, warranties, precise descriptions, and responsive customer service also help build trust. A grading system that aligns with industry standards ensures that product condition is clearly communicated to buyers. If the customer promise doesn’t match the product condition, it can damage brand reputation and reduce resale value.

Companies with robust marketplace management systems can expand their reach quickly, improve asset recovery rates, and increase total revenue from refurbished products. Effective secondary market strategies also support circular economy goals by extending product life cycles and reducing waste. In short, maximizing value in secondary markets requires dynamic multiplatform management, transparent and standardized product assessment, and technological coordination of compliance, trust, and fulfillment across online channels.

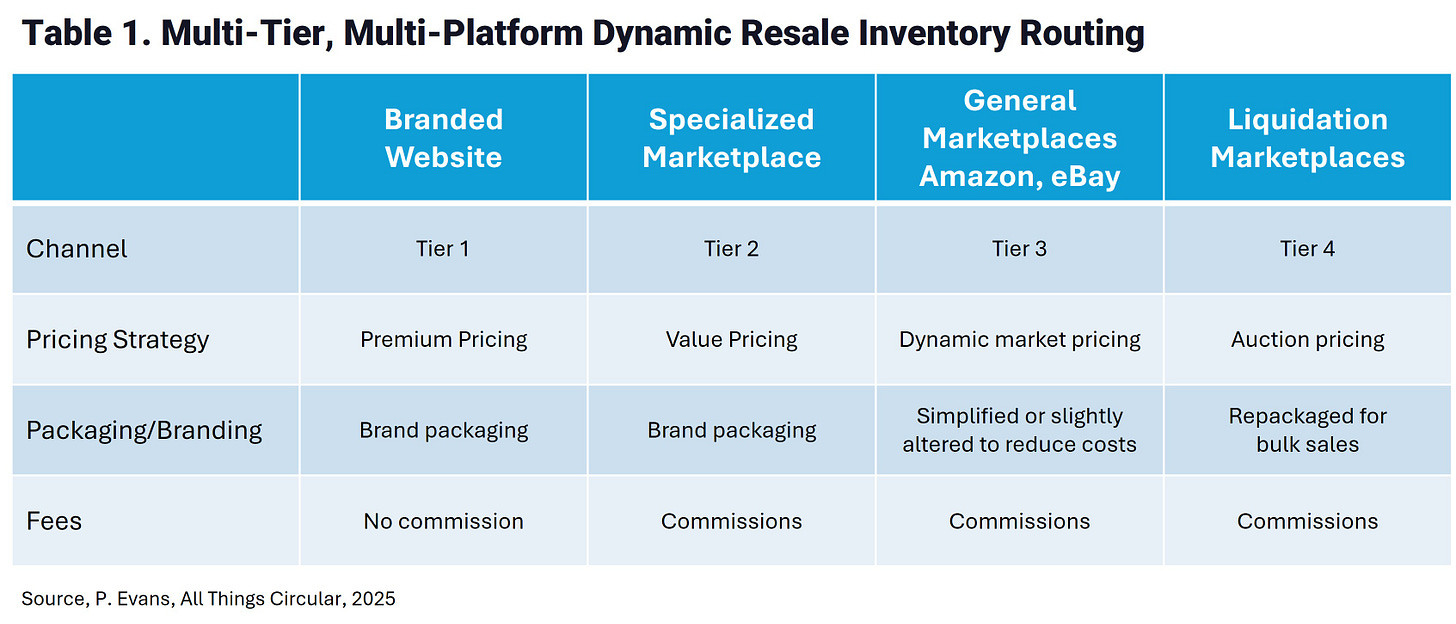

Multi-tiered resale strategy

There are several resale channel options. One option is to establish a brand-owned resale on the primary website or launch a dedicated, parallel resale portal. This approach is gaining popularity as resale markets grow, driven by consumer demand for sustainability, better value, and authentic brand experiences. By offering in-house resale, brands control customer relationships, pricing, and product positioning, which helps protect brand equity and capture valuable data on secondary market demand. These products are branded and priced at a premium, typically 5% to 15% higher than market prices on large platforms like Amazon or eBay. This approach is ideal for companies with a well-known brand name and a desire for a controlled, high-quality customer experience, while avoiding third-party platform commissions.

The second option involves partnering with specialized resale marketplaces catering to niche customers. These platforms enable brands to reach target audiences looking for value, willing to pay slightly above general resale market prices—typically 1% to 9% above prices on large marketplaces. This tier benefits from the marketplaces’ curation, trust mechanisms, and targeted marketing without directly competing with the brand’s premium channel. A growing number of circular platforms focus on specific verticals or products, like smartphones.

The third option is selling on mainstream large marketplaces like Amazon, eBay, Walmart, or regional platforms outside the brand’s normal direct sales channels, including emerging markets like Latin America. Prices in this tier normally align with or slightly below market rates to maximize sales volume and reach a broad customer base. Additionally, liquidation services operate at this level, where inventory is sold in bulk to wholesalers or liquidators at steep discounts. This outlet is essential for efficiently clearing excess, slow-moving, or end-of-life inventory, minimizing holding costs, and avoiding channel conflict with premium and specialized resale channels.

Distinct from these, a fourth-tier engages liquidation marketplaces where inventory is sold in bulk to wholesalers or liquidators through auction platforms like Liquidity Services or B-Stock. This tier serves as a strategic exit channel for excess, returned, or end-of-life stock that cannot be effectively sold through higher tiers. Although liquidation typically yields lower financial recovery—often between 2% and 15% of retail value—it is crucial for clearing inventory, minimizing holding costs, and avoiding channel conflict with more controlled resale environments. Liquidation partners absorb operational complexity by handling mixed inventory grades and bulk sales, enabling brands to efficiently monetize slow-moving or less desirable stock.

A sophisticated resale strategy optimizes resale value by segmenting inventory across multiple controlled channels to balance brand equity, market reach, and recovery rates. By maintaining a brand-owned resale platform, a company can command premium prices, retain direct access to customer data, and reinforce trust and quality perception. Partnering with specialized niche marketplaces provides a mid-tier channel to target value-driven customers at modestly higher-than-market prices, leveraging platform curation and marketing reach. Mainstream and global marketplaces expand reach and liquidity for lower-priced inventory, ensuring competitive turnover without eroding premium tiers. Finally, structured liquidation through auction platforms maximizes residual recovery on surplus or end-of-life items while protecting pricing integrity across higher-value channels.

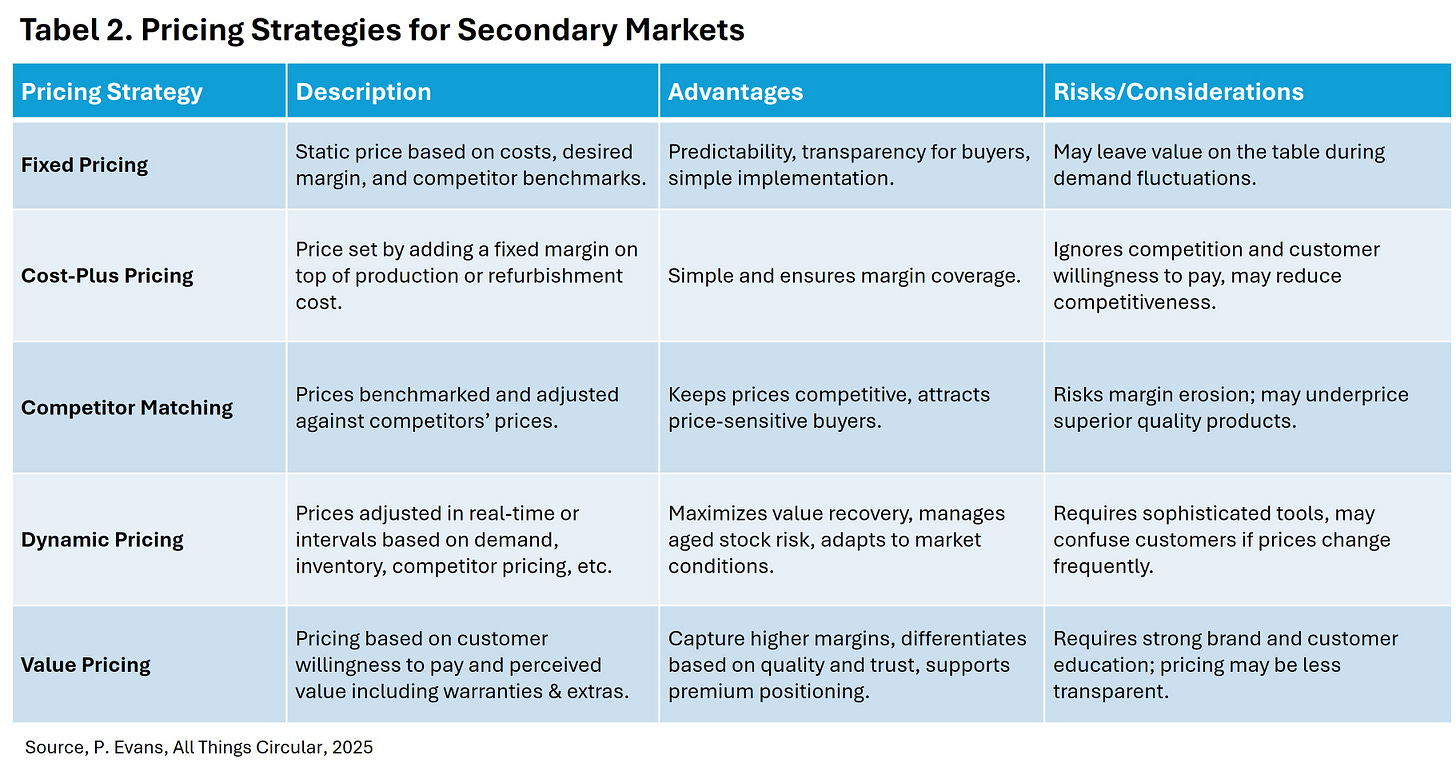

Pricing Strategies

Companies selling into the secondary market can use a combination of pricing strategies rather than relying on just one.3 The choice and operationalization of specific pricing strategies depend on factors such as the nature of the inventory, product condition variability, customer segments, platform requirements, competitive landscape, and overall business objectives. For example, a company might use fixed pricing for standardized or high-demand refurbished products to maintain clarity and predictability, while applying dynamic pricing models to slow-moving or aging inventory to optimize recovery value. Competitor matching might be employed to remain competitive in price-sensitive segments, whereas value-based pricing could be reserved for premium refurbished products with warranties or unique enhancements that command higher prices.

Factors influencing the choice of pricing strategies include the product condition, market demand fluctuations, and channel-specific rules or policies. Operational considerations such as availability of pricing automation tools and integration capabilities across sales platforms also drive strategy selection. Moreover, pricing strategies may evolve over the product lifecycle or vary within multi-channel frameworks, necessitating flexible and data-driven approaches. Firms that effectively balance cost, competitive positioning, and customer willingness to pay across multiple pricing strategies can enhance profitability, inventory turnover, and customer trust in the complex secondary market environment.

Together, these four tiers enable brands to optimize revenue and inventory management by balancing brand control, pricing, customer segmentation, and operational efficiency in the resale ecosystem. This layered approach protects premium brand value at the top while ensuring broad market presence and responsible inventory disposition through liquidation at the base tier.

Packaging and Branding Strategies

When packaging and branding products for the secondary market, brands need to consider several key factors to meet customer expectations, protect their reputation, and maximize sales across different resale tiers and platforms. Packaging is a strategic brand asset that conveys product quality, value, and brand positioning. For premium resale channels, brands usually keep or closely match their original packaging and branding to maintain the perception of high value and deliver a consistent, trusted experience. This includes using branded materials, professional finishes, and possibly premium touches like embossing or metallic foil to signal exclusivity.

In contrast, for specialized marketplaces or value-driven resale platforms, packaging may be simplified or slightly altered to reduce costs while still clearly reflecting brand identity and providing adequate protection during transit. Transparent labeling that communicates product refurbishment status, warranty coverage, and condition grading is crucial for building buyer trust. For mass-market channels or more price-sensitive tiers, packaging tends to be more functional and minimalist, sometimes generic or clearly marked as refurbished to differentiate from new product sales and manage customer expectations.

For liquidation marketplaces and bulk sales, packaging is typically minimal or consolidated to lower costs and optimize logistics. In some cases, products may be repackaged into bulk or multipacks without individual branding details, ensuring cost efficiency at scale.

Overall, the approach to packaging and branding in secondary markets varies by resale tier and platform to balance brand protection, customer experience, and cost-effectiveness. Importantly, packaging should always provide transparency about the product’s condition and refurbishment, reinforce the brand’s core values (including sustainability where applicable), and comply with any platform-specific requirements. This tiered packaging strategy enhances value capture by tailoring the brand presentation to meet the needs and expectations of diverse customer segments across the resale ecosystem.

Data Requirements

To get the best resale value across multiple platforms, companies need a complete set of data that helps them track and make informed decisions. The most important data includes detailed product condition and history, such as grading, defect documentation, refurbishment notes, and warranty information. This detailed information helps sellers communicate clearly with buyers, set prices accurately, and avoid returns or disputes. They also need data on consumer demand and competitor pricing, which involves tracking current and historical prices for similar products, broken down by condition, brand, and channel. This helps sellers price their products correctly compared to similar inventory and market trends.

Another essential input is sales and inventory performance data, which provides insights into turnover rates, sell-through, channel profitability, and inventory aging at the product level. These metrics help sellers adjust prices dynamically and make decisions about restocking or clearing out inventory across different marketplaces. Additionally, automated updates or alerts about marketplace policy changes are crucial for staying compliant. These updates cover changes to platform rules and new regulations that can affect listing eligibility, pricing, and promotions. By combining all these data streams, often through APIs and analytics platforms, sellers can quickly respond to changing market conditions, refine their multichannel strategies, and maintain customer trust by delivering consistent product quality and transparent pricing.

Essential Software Tools

To get the best resale value, companies need a range of software tools that can handle multichannel resale operations with automation, data insights, and seamless integration. While there are many tools available, some stand out.

Platforms like Linnworks, Loop Returns, and Syncio help with multichannel listing and inventory management. They offer real-time stock synchronization, centralized product and order management, and prevent overselling across channels like eBay, Amazon, Shopify, and Back Market. These tools can handle complex product structures, such as bundles or serialized products, which are crucial for refurbished goods with grading or warranty variations. Loop Returns focuses mainly on returns and exchanges, while Syncio specializes in inventory syncing across Shopify stores.

Software like ShipStation or Multiorders automates shipping processes, label generation, and returns management. It integrates directly with sales channels and logistics providers to enhance customer experience through timely order tracking and issue resolution. Advanced features include branded customer portals and streamlined return merchandise authorization, allowing users to turn returns into revenue through exchanges and upselling.

Automated pricing engines, such as Pricemoov and RepricerExpress, analyze market trends, competitor prices, inventory aging, and consumer demand to recommend or execute dynamic price adjustments. This helps sellers optimize recovery and reduce obsolete stock risks. Even newer companies like Pricient are introducing AI-powered cloud-based elastic pricing engine that brings advanced enterprise-grade variable pricing technology that helps to determine a customer’s willingness to pay.

Orchestration platforms like Gierd support multichannel resale strategies. Gierd’s platform helps brands maximize value from returned and refurbished products by combining sales, pricing, refunds, and supply data into one system. This gives full visibility into profitability and performance. The platform optimizes pricing and inventory in real time, considering factors like condition, competitor pricing, and demand. This enables brands to price and sell returned products effectively across multiple marketplaces.

Conclusion

To succeed in secondary markets, brands need a sophisticated approach that tackles the unique challenges of selling returned, used, and refurbished products. This includes creating a dynamic strategy that combines multiple sales channels, transparent product grading, and automation and AI to ensure quality and build trust with buyers. By using a multi-tiered resale strategy, brands can separate their inventory and pricing, offering premium products on their own platforms, value-driven sales on specialized marketplaces, broad reach through major online platforms, and efficient inventory clearance through liquidation marketplaces.

To learn more about how to win in secondary markets, consider signing up for our All Things Circular Masterclass. We have taught this course now in Barcelona, Amsterdam, Hong Kong, Miami, New York, Denver, Dallas and Las Vegas. Our next course will be held at the ITAD Europe 2026 Conference in Nice, France.

We also hold tailored masterclasses for companies seeking to build or improve their existing operations. For more details see: https://allthingscircular.com/masterclass/

References