What do IKEA, Harley-Davidson, and The North Face have in common? They have all established and evolved resale marketplaces.

In a significant shift in retail strategy, major brands are now venturing into the world of resale, launching their own marketplaces for pre-owned products. This trend, exemplified by industry giants like IKEA, Harley-Davidson, and The North Face, reflects not only a growing emphasis on sustainability and changing consumer attitudes but also a defensive move to recapture business that has been leaking to third-party resale marketplaces.

By evolving their own resale platforms, these brands are aiming to maintain control over their products' entire lifecycle, tap into new revenue streams, and prevent platforms that specialize in resale from capitalizing on their brand equity. Each of these companies has introduced unique features to their resale platforms, setting them apart in the burgeoning pre-owned sector while simultaneously protecting and extending their market presence. Some have built their own marketplaces, while other brands have turned for support to the growing number of third-party resale-as-a-service (RaaS) providers, which specialize in circular logistics.

IKEA Preowned

IKEA's journey into the resale market began with the Buy Back & Resell program, which launched in the United States in 2021.1 This program allowed customers to return gently used IKEA furniture to physical stores in exchange for store credit. This initiative was part of IKEA's broader sustainability goals and aimed to reduce waste by giving products a second life. However, the program was limited in scope and operated primarily through IKEA's brick-and-mortar locations.

Recognizing the growing demand for secondhand furniture and the shift towards online shopping, IKEA has evolved its approach with the introduction of IKEA Preowned in August 2024.2 This new online platform represents a significant expansion of IKEA's resale efforts, transitioning from a store-based buyback program to a peer-to-peer marketplace. IKEA Preowned allows customers to buy and sell used IKEA products directly to each other, leveraging IKEA's brand recognition and existing customer base.

Currently being tested in Madrid and Oslo, IKEA Preowned is set for a potential global rollout by December if the trials prove successful. This new platform incorporates advanced features such as AI-assisted listings, which automatically populate product details and images from IKEA's database. It also offers sellers the choice between cash payment and IKEA vouchers with a 15% bonus, incentivizing continued engagement with the IKEA ecosystem.

Harley-Davidson H-D1 Marketplace

For decades, Harley-Davidson largely ignored the resale marketplace for its motorcycles, allowing third-party websites to dominate this space. Before the establishment of H-D1 Marketplace, pre-owned Harley-Davidson motorcycles were primarily traded on platforms like eBay, Craigslist, and specialized motorcycle marketplaces. This hands-off approach meant that the company had little direct involvement or control over the resale of its iconic bikes.

In a major strategic shift, Harley-Davidson launched H-D1 Marketplace in July 2021. This move marked the company’s first major effort to create a comprehensive, company-backed online platform for pre-owned motorcycles.3 Initially, H-D1 Marketplace focused on dealer listings of pre-owned and Harley-Davidson Certified motorcycles, signaling the company's commitment to entering the resale market in a meaningful way. H-D Certified program sets standards for pre-owned motorcycles. Each bike undergoes a rigorous 110-point inspection carried out by the company's dealer network, ensuring that every certified pre-owned Harley-Davidson meets the brand's standards for quality and performance. This comprehensive inspection process not only maintains the brand's reputation for excellence but also provides buyers with peace of mind when purchasing a pre-owned motorcycle.

Harley-Davidson's engagement with the resale market continued to evolve. In January 2023, the company expanded H-D1 Marketplace to include listings from private sellers, further solidifying its position in the pre-owned motorcycle market. This expansion aligns with Harley-Davidson's "Hardwire" strategic plan, which aims to enhance customer experience and recognizes the importance of the pre-owned motorcycle market in the company's overall ecosystem.

The North Face Renewed

The North Face's Renewed program began in 2018 as a pilot initiative to promote circular economy principles by refurbishing and reselling returned, defective, or damaged apparel.4 This initial phase focused on reducing environmental impact while providing consumers with affordable, high-quality outdoor gear. Over time, the program gained traction, and The North Face recognized the need to enhance its operations to meet the growing demand for sustainable products. In 2022, The North Face partnered with Archive, a resale technology company, and Tersus Solutions, a cleantech and logistics provider, to elevate the Renewed program.5

The partnership with Archive introduced new technological capabilities, allowing The North Face to streamline the resale process from product identification and cleaning to repairs and site listing. Archive's platform provides The North Face with detailed visibility into the lifecycle of each Renewed item, ensuring that products meet the brand's quality and performance standards. This integration enables The North Face to accurately price items for resale and gain insights into product durability and customer preferences.

Tersus Solutions plays an important role in the revamped program by leveraging its proprietary waterless cleaning technology and logistics expertise. Based in Denver, Tersus handles the cleaning, repair, refurbishment, and fulfillment of Renewed items, supporting The North Face's commitment to sustainability. The collaboration with Tersus allows The North Face to maintain high standards while minimizing environmental impact.

Through these partnerships, The North Face has transformed its Renewed program into a sophisticated resale platform. The enhanced capabilities provided by Archive and Tersus enable The North Face to combine all circular initiatives, such as repair, recycling, and reselling, into one cohesive system. This evolution not only supports The North Face's environmental commitments but also adapts to changing consumer preferences in the resale space, positioning the brand as a leader in sustainable retail practices.

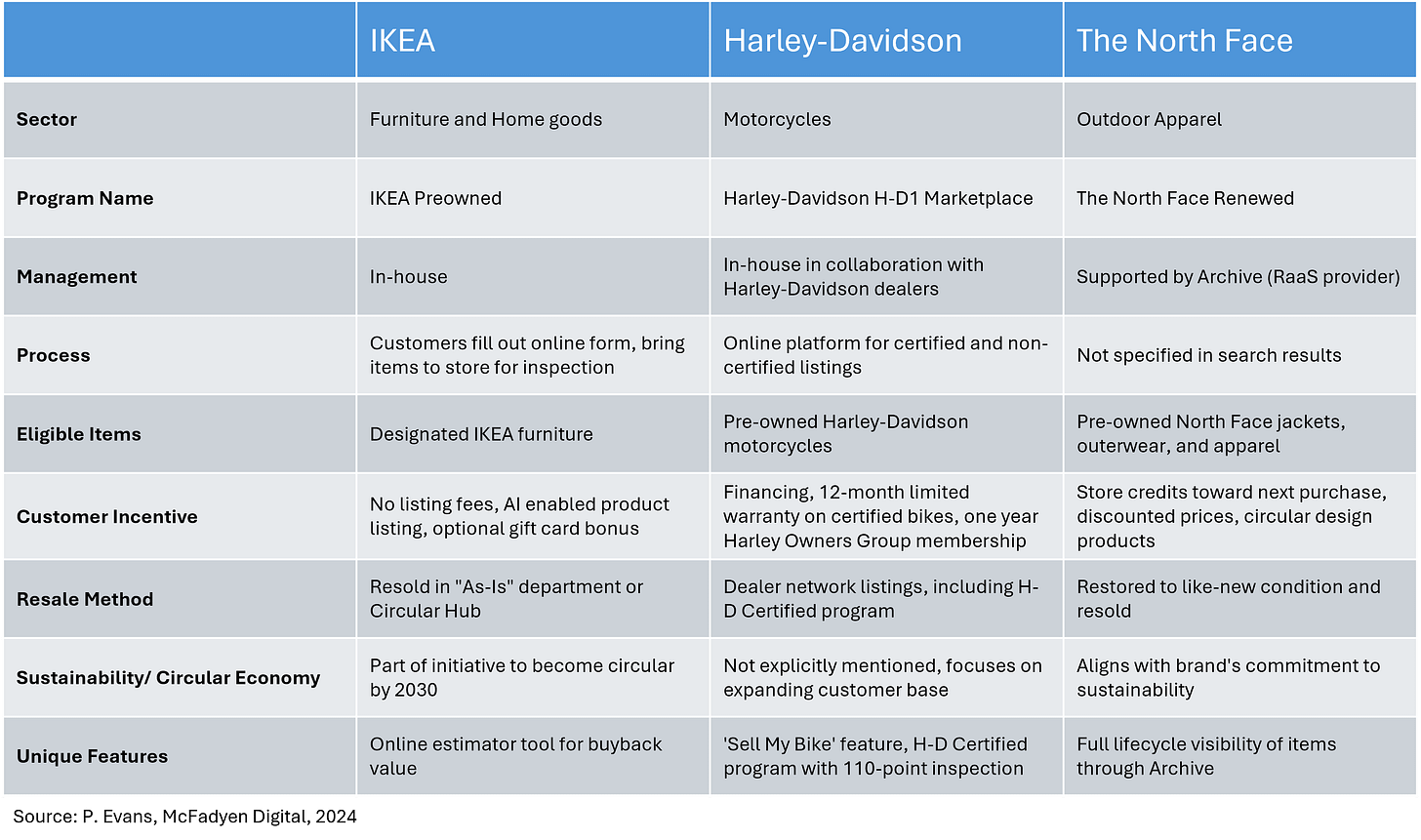

A side-by-side comparison of the resale platforms and how they work between IKEA, Harley-Davidson, and The North Face are presented in Figure 1.

Figure 1. Major Brand Resale Platform Comparison

Key Market Drivers

Major brands are establishing their own resale marketplaces for reasons that extend beyond sustainability and customer demand. By managing their own platforms, brands can control the full lifecycle of their products, allowing them to engage not only with the initial purchaser but also with second and potentially third owners. This extended customer relationship fosters ongoing brand loyalty and encourages repeat purchases across multiple product lifecycles. Resale marketplaces enable brands to maintain relationships with customers long after the initial sale, providing valuable data on product usage, longevity, and customer preferences. This information can inform and shape future product development and marketing strategies.

Operating their own resale platforms also allows brands to maintain quality control and authenticity standards for secondhand items, protecting the brand's reputation and ensuring a consistent brand experience, even in the secondary market. The rise of sophisticated third-party resale platforms has created competition for brands in the secondhand market. By establishing their own resale marketplaces, brands can reclaim market share and prevent these third-party platforms from becoming the go-to destinations for their pre-owned products. Additionally, owning the resale process provides brands with valuable data on product durability, resale value retention, and customer behavior in the secondary market, which can be used to improve product design, pricing strategies, and marketing efforts.

Resale marketplaces open new revenue opportunities for brands, allowing them to profit from the same product multiple times throughout its lifecycle. This can include transaction fees, refurbishment services, or upselling new products to secondhand buyers. Furthermore, resale platforms can attract price-sensitive customers who might not typically purchase new items from the brand, providing an opportunity to introduce these customers to the brand ecosystem and potentially convert them into full-price buyers in the future. Managing their own resale platforms also allows brands to demonstrate a tangible commitment to sustainability goals, enhancing their reputation and appealing to environmentally conscious or price-sensitive consumers.

As more consumers embrace secondhand shopping, brands with established resale marketplaces gain a competitive edge over those without such offerings. By establishing their own resale marketplaces, major brands are positioning themselves to capitalize on the growing secondhand market while maintaining control over their brand identity, customer relationships, and product lifecycle. This strategy allows them to adapt to changing consumer preferences and defend against the encroachment of third-party resale platforms, ensuring they remain relevant and competitive in an evolving retail landscape.

Conclusion

As the resale market grows, more brands are likely to follow in the footsteps of IKEA, Harley-Davidson, and The North Face. By taking control of their products' entire lifecycle, these companies are not only tapping into a lucrative market but also reshaping the retail landscape. The unique features introduced by each brand – IKEA's online estimator tool, Harley-Davidson's comprehensive certification process, and The North Face's full lifecycle visibility – demonstrate the innovative approaches companies are taking to differentiate themselves in the resale market.

This shift represents a significant change in how brands approach product lifecycles and customer relationships. They are increasingly thinking not only about customer number one, who first buys their product, but subsequent customers two and potentially three and four.6 Brands that embrace resale and establish circular logistics capabilities are positioning themselves to lead the growing retail shift. The future will see leading brands more closely integrate new and pre-owned products, with trust and quality assurance at the forefront of these initiatives.

Footnotes