Industrial robotics markets are undergoing transformation, following a pattern seen in other durable goods markets such as vehicles, heavy machinery and smartphones. As the industry matures, a robust secondary market is emerging, driven by the growing installed base of industrial robots coupled with the power of digital marketplaces. This trend holds the potential to advance a more circular economy for a wide array of industrial robots. In the process, it promises to reshape the industry, offering new opportunities and challenges for manufacturers, distributors, third-party marketplace providers, and end-users alike.

The Rise of the Secondary Market

The conditions are ripe for a robust secondary market in industrial robotics enabled by the rapidly increasing installed base of robots. According to the World Robotics 2024 report, there are now over 4 million industrial robots operating in factories and other facilities worldwide.1 Some forecasts project the value of the market to reach $163 billion by 2032, up from $38 billion in 2020. This represents a compound annual growth rate (CAGR) of over 12 percent from 2023 to 2032.2

The large and growing number of robots in circulation creates a substantial pool of potential used inventory. This used inventory can be channeled to digital marketplaces that specialize in grading, repair, reverse logistics and resale. Secondly, technological advancements play a role. As newer, more advanced robot models enter the market, older models become available for resale, fueling the secondary market. Cost efficiency is another driving factor, with used or refurbished robots offering significant cost savings for businesses, particularly small and medium-sized enterprises looking to automate their operations. Lastly, there's a growing focus on sustainability. Extending the lifecycle of industrial robots aligns with increasing environmental concerns and corporate sustainability goals, making the secondary market an attractive option to advance carbon reduction and material efficiency targets.3

The Power of Digital Resale Marketplaces

Digital platforms are emerging as important enablers of circular transactions in the robotics industry. The sponsors of these marketplaces come from two key sources. One is the emergence of third-party operators, who independently build and operate a resale marketplace. The other are manufacturer-operated eCommerce platforms for used and refurbished robots.

Third-party platforms have emerged as important players in facilitating more circular markets for industrial robots. As shown in Table 1, these platforms include Robots.com, Eurobots, IRS Robotics, Robots Done Right, Revelation Machinery , Global Robots and RobotShop.com. These marketplaces offer a wide range of brands and models, catering to diverse automation needs across various industries and use cases. They provide an essential service by reducing the cost of discovery, connecting buyers with sellers, and offering additional value by grading the quality and durability, arranging logistics, and providing technical support. Some of these platforms such as Eurobots are dedicated to only selling used robots, whereas others, such as Revelation Machinery, include used robots within a broad range of other used industrial equipment.

In parallel, industrial robot manufacturers have recognized the potential of the used robot market and have launched their own resale platforms.4 Examples include ABB Robotics WebShop, KUKA Used, FANUC Robot Store, and Yaskawa Motoman Certified Pre-Owned Robots (see Table 2). They typically provide refurbished robots that have been worked on in their own dedicated facilities, ensuring quality and reliability based on takeback programs. The used robots are usually kept in stock for immediate availability and can be customized according to customer requirements. They cater to various applications, including welding, foundry work, palletizing, and assembly. Despite being pre-owned, these robots undergo quality testing, and manufacturers often provide warranties.

However, many manufacturers have yet to fully develop their takeback and resale capabilities. Some that have takeback initiatives have not integrated these programs seamlessly into their online presence. This lack of prominence can make it difficult for customers looking for second-hand options to easily find and explore these options. Some manufacturers have yet to establish official takeback programs and largely ignore the secondary market, leaving resale to third-party companies refurbishing and revitalizing robots that would otherwise be discarded.

Despite the mixed picture, the resale programs by robot manufacturers are growing, representing another step in making industrial automation more accessible, even if finding them sometimes requires additional effort from potential buyers.

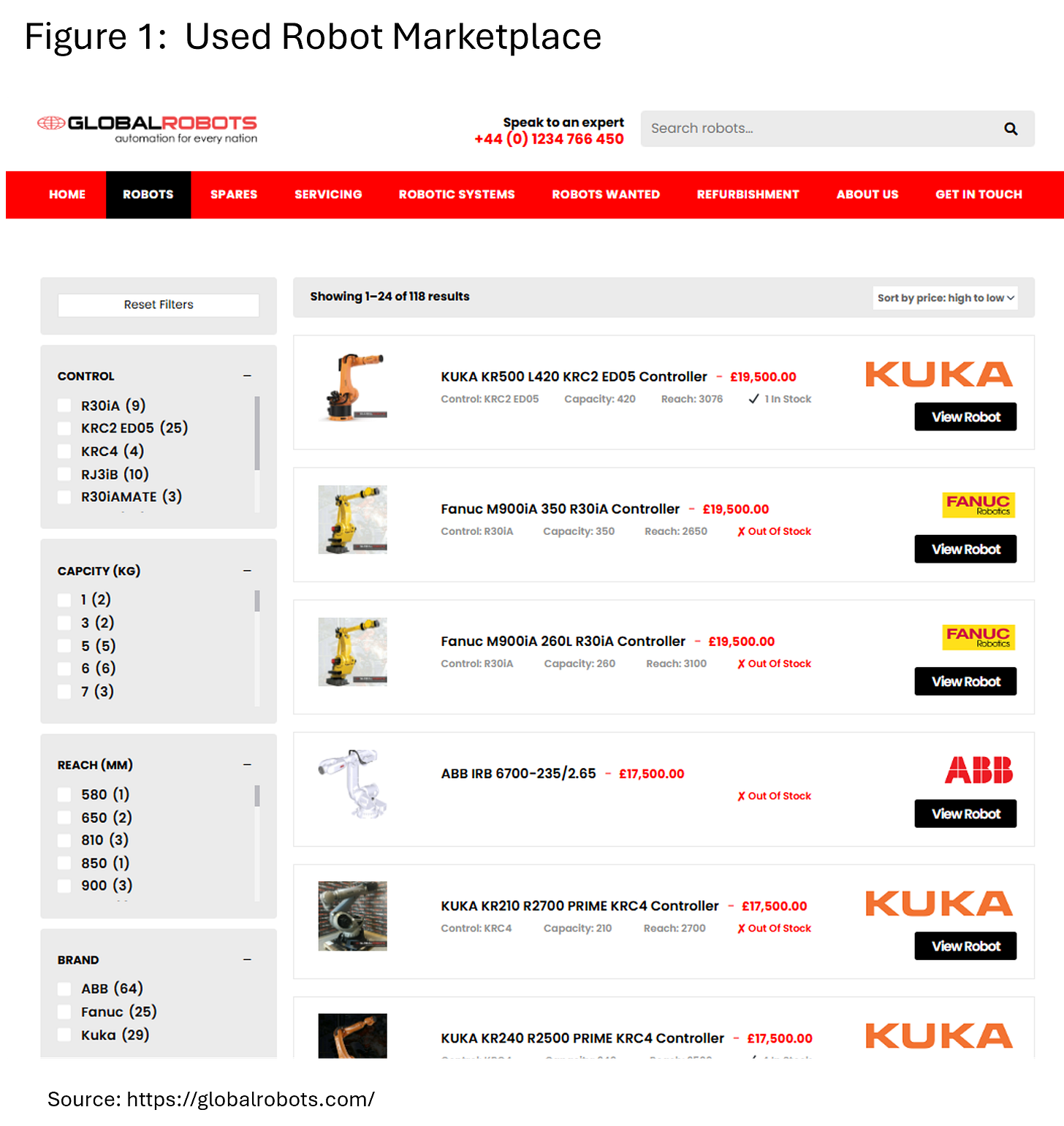

Resale marketplaces, like the one illustrated in Figure 1, offer several key advantages. One of the primary benefits is reduced transaction costs. These platforms streamline the buying and selling process, eliminating traditional intermediaries and centralizing transactions, which makes the entire process more efficient and cost-effective. They also facilitate improved buyer-seller matching. Advanced search and filtering options help buyers find specific robot models or capabilities more easily, while sellers can reach a broader audience, increasing the likelihood of successful transactions.

Another significant advantage is the network effect. As more participants join these platforms, the value for all users increases, creating a more competitive marketplace with better prices and a wider selection. This self-reinforcing cycle can lead to rapid growth and adoption of these digital marketplaces. Lastly, these platforms often implement standardization and trust-building measures. Many platforms use standardized product descriptions and condition ratings, making it easier for buyers to compare options. Some also offer buyer protection and dispute resolution services, which increase trust in transactions and help overcome the hesitation that some buyers might feel when purchasing used industrial equipment.

These advantages have increased access to robotics technology, opening up new opportunities for a broader range of customers. These platforms have made it possible for smaller businesses, startups, and educational institutions to acquire advanced robotic systems at more affordable prices compared to new equipment. By offering refurbished and pre-owned robots from well-known manufacturers, these marketplaces have lowered the financial barrier to entry for automation technology. This has enabled organizations with limited budgets to explore and implement robotic solutions that were previously out of reach, allowing them to improve productivity, efficiency, and competitiveness.

Additionally, these online platforms provide a wide selection of robots suitable for various applications, from welding and assembly to material handling and packaging, making it easier for new users to find equipment tailored to their specific needs. The availability of detailed product information, user reviews, and expert support on these marketplaces has also helped improve the information available about industrial robotics to newcomers, providing them with the knowledge and confidence to invest in automation. As a result, used robot marketplaces are playing a crucial role in accelerating the adoption of robotics across diverse industries and use cases.

Unique Issues Raised in Selling Used Robots

Selling used industrial robots differs significantly from selling typical goods online due to the complexity, high value, and specialized nature of these machines. Industrial robots are highly intricate systems with sophisticated mechanical, electrical, and software components, requiring specialized knowledge for proper assessment. Sellers need expertise in robotics or must employ qualified technicians to evaluate and prepare robots for resale effectively.

To ensure quality and durability, sellers must perform or engage partners that perform rigorous testing that includes mechanical inspections to check for wear on gears and bearings, electrical testing to verify the integrity of wiring and motors, software diagnostics to ensure programming functions correctly, accuracy and repeatability tests to measure precision in movements, and load testing to confirm the robot can handle its rated payload capacity.5 In many cases, these inspections will reveal the need for repairs. As a result, many sellers offer refurbishment services, which may involve replacing worn components, updating software, repainting for cosmetic improvements, and making calibration adjustments.

Detailed documentation is crucial in this process, providing buyers with the robot's operational history, including maintenance records, previous applications, repairs or modifications made, and original manufacturer specifications. Additionally, used industrial robots often require customization or reconfiguration for new applications, with sellers frequently offering integration services to help buyers adapt the robots to their production lines. Due to the high value and critical nature of these machines, sellers typically provide warranties or guarantees on refurbished units that cover overall functionality for a specified period, performance metrics such as accuracy and repeatability, and support for installation.

Compliance with current safety standards is also essential; sellers must ensure that used robots meet regulations that may have changed since their original manufacture date. This could involve updating safety features and providing current safety documentation. Finally, the logistics of transporting and installing industrial robots require specialized equipment and expertise. Sellers often arrange these services, which is not typically necessary for standard online goods.

By addressing these factors comprehensively—testing, refurbishment, documentation, customization, warranties, compliance, and logistics—sellers of used industrial robots can instill confidence in buyers regarding their purchases, ensuring reliable performance in new applications. This thorough approach distinguishes the sale of used industrial robots from typical online transactions due to the high-value and mission-critical nature of these machines in industrial settings.

Benefits of Going Circular

The growth of a secondary market for industrial robots offers numerous benefits to the industry and individual businesses. Increased accessibility is a key advantage. More affordable options make robotics technology accessible to a wider range of businesses, potentially accelerating automation across industries. These expanded options of robotics could lead to increased productivity and competitiveness for smaller businesses that previously couldn't afford to automate.

Extended product lifecycles are another significant benefit. Encouraging resale and refurbishment helps extend robots' useful life, promoting sustainability and reducing electronic waste. This aligns well with the growing corporate and consumer focus on environmental responsibility. The secondary market also contributes to overall market efficiency. These platforms provide valuable market data on pricing and demand for used robots, helping to optimize resource allocation in the industry. This information can guide both buyers and sellers in making informed decisions.

Furthermore, the emergence of a robust secondary market can serve as an innovation catalyst. It could drive innovation in robot design, encouraging manufacturers to create more modular or easily upgradeable robots to maintain value in the resale market. This could lead to more sustainable and flexible robotics solutions in the long term.

Following the Pattern Other Resale Markets

The emergence of a circular economy for industrial robots follows patterns seen in other markets for durable goods. The smartphone industry provides one example. In the early years, when the smart phone entered the market in 2007, there was little secondary market. The vast majority of consumers bought new and there were few phones available for resale. However, this changed as the volume of phones grew and new models where introduced. In recent years, the used smartphone market has grown rapidly, than 195 million used smartphones, including officially refurbished and used smartphones, were shipped in 2023 worth an estimated $72.9 billion.6 This trend has been further advanced through the growth of marketplaces that specialize per-owned phones.

The automotive industry offers another relevant example. The used car market has long been a significant part of the automotive industry, with certified pre-owned programs adding value and trust to the secondary market. These programs, often run by manufacturers in partnership with dealerships, provide quality assurance and warranties for used vehicles, increasing consumer confidence in pre-owned purchases. In the case of heavy machinery, industries like construction and agriculture have well-established markets for used equipment, often facilitated by specialized digital platforms.7

These resale marketplaces demonstrate that even large, complex, and expensive equipment can have a thriving secondary market when supported by the right infrastructure and services.

Challenges and Opportunities

While the potential for a robust used robot market is clear, there are unique challenges to overcome. For example, the need for customization is a significant issue, as many industrial robots must be configured for specific applications, potentially limiting their resale potential. Integration complexity presents another hurdle. Unlike commonly resold goods like smartphones, robots often require significant integration efforts, which can complicate resale and may necessitate specialized services to assist with re-deployment. The need to involve specialized companies to perform the integrations can increase the challenge of completing transactions through digital-only channels. Rapid technological change in the robotics field poses another challenge. Fast-paced robotics innovation can lead to quicker obsolescence of older models, potentially reducing their value in the secondary market.

However, these challenges also present opportunities for businesses that can effectively address them. Companies specializing in robot refurbishment, reintegration, and customization for second-life applications can find a lucrative niche in this emerging market. This is especially true for companies that integrate the physical aspects to reverse logistics with digital platforms that can remove friction at every step in the process.

To compete effectively circular platform operators must invest in a comprehensive technology and service stack. Scalable cloud-based infrastructure and microservices architecture enable platforms to handle higher traffic volumes and adapt to evolving business needs. Advanced analytics powered by AI provide insights that optimize operations and enhance user experiences. Furthermore, robust inventory management systems are essential for tracking and categorizing diverse equipment, while seamless logistics integration ensures smooth handling of large assets. Implementing rigorous inspection and grading processes backed by guarantees helps maintain the platform's reputation and customer satisfaction.

Conclusion

As the robotics market continues to mature, the emergence of a significant secondary market for used and refurbished robots is inevitable. With the primary market for industrial robots currently doubling every 6-7 years, we can expect the market for used robots to also exhibit strong growth in the future. Digital marketplaces will play a crucial role in enabling a more circular economy for industrial robots, creating new business opportunities and potentially making this technology more accessible to a broader range of businesses. This trend not only promotes sustainability but also drives innovation and greater material efficiency.

The shift towards a circular economy in industrial robotics represents a significant opportunity for all stakeholders. Manufacturers, third-party marketplaces, and end-users who embrace this trend early stand to benefit from new revenue streams, increased market share, and more sustainable business practices. As the market evolves, we can expect to see continued innovation and greater competition.

Sources