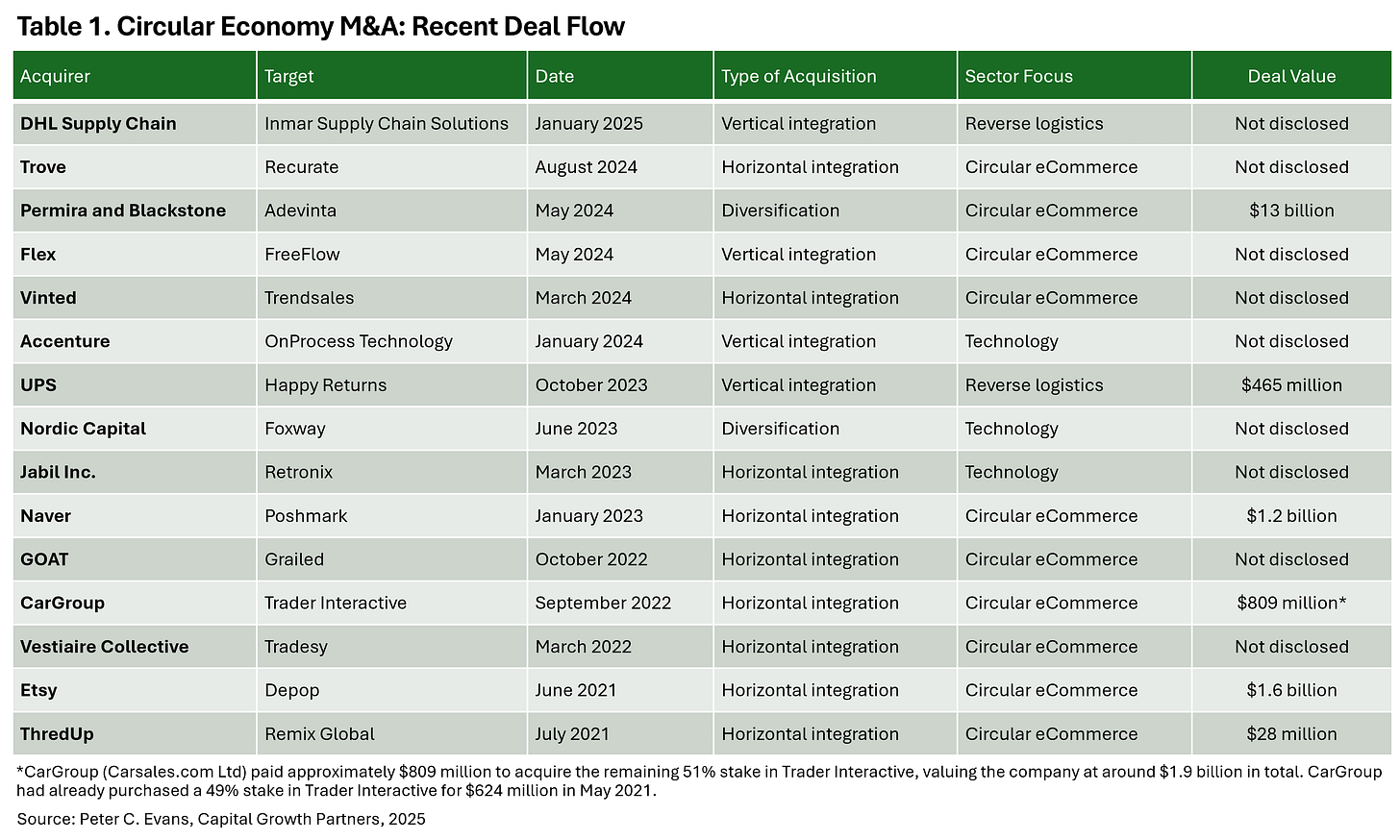

Circular Economy M&A is gaining momentum. Since 2021, there have been a growing number of deals around the world. This article examines 15 of these deals presented in the graphic below. An in-depth review provides insights into the type of acquisitions, sector focus, scaling strategy, and other key trends.

The total amount exchanged in these deals is unknown. The financial terms of over half of the deals were not disclosed. However, the tally for the ones that were disclosed is substantial. Six deals with terms made public sum to $17.6 billion (See Table 1). The largest among these was the Permira and Blackstone led consortium that acquired Adevinta, a leading online classifieds business, for approximately $13 billion. Other deals that surpassed $1 billion include Etsy’s acquisition of Depop, Naver’s acquisition of Poshmark and CarGroup’s acquisition of Trader Interactive. Again, while it the amounts are unknown for the undisclosed deals, it is not unreasonable to assume that these deals add up to several billion dollars given the size of the acquirer and target. So, the total value of these 15 deals is likely over $20 billion.

Taken together these deals reveal several important trends:

Type of Acquisition

One observation is that they cover the three classic types of M&A—vertical integration, horizontal integration, and diversification. Vertical integration involves acquiring companies to gain greater control of multiple stages of their supply chain, from production to distribution. Horizontal integration occurs when companies merge with or acquire competitors to expand market reach, achieve economies of scale, and strengthen their competitive position. Diversification involves acquiring firms in different markets or with different products, allowing companies to explore new growth opportunities while mitigating risks. Each of these objectives is present, with a particularly strong emphasis on horizontal integration. Out of the 15 combinations, nine involved horizontal integrations.

Building Reverse Logistics Capabilities

The growing issue of returns, which have ballooned to over $890 billion for the US market alone, is driving strong demand for improved efficiency, sustainability, and customer experience in the returns process.1 The dominate logistics providers are responding by enhancing their reverse logistics and returns management capabilities. The most recent example is the acquisition of Inmar Supply Chain Solutions by DHL Supply Chain announced on January 9, 2025. It is a move that positions DHL as the largest provider of reverse logistics solutions in North America. The acquisition brings 14 return centers and approximately 800 associates into DHL's fold, significantly expanding its North American footprint to over 520 warehouses and 52,000 employees.2

Prior to this deal, UPS acquired Happy Returns from PayPal on October 25, 2023, boosting reverse logistics capabilities.3 Happy Returns is a specialized software and reverse logistics company that provides innovative, no-box, no-label return solutions for merchants and consumers. By integrating Happy Returns' digital platform with UPS's extensive network, the combination offers enhanced returns options at more than 12,000 locations across the US improving pickup and delivery density, and a more cost-effective service.

By acquiring companies with specialized expertise in e-commerce returns, DHL and UPS are not only expanded their offerings but also integrating advanced software and analytics capabilities to streamline the returns process. These acquisitions aim to create more efficient, user-friendly return experiences for both consumers and retailers. Additionally, there's environmental benefits from streamlining recommerce and greater waste reduction.

Race to Deepen Tech Capabilities

Several acquisitions illustrate the pressure to keep pace with the accelerating pace of technology change. One example is Accenture's acquisition of OnProcess Technology in January 2024.4 Through this acquisition, Accenture gained new capabilities in automation, artificial intelligence, and data-driven decision-making capabilities OnProcess had scaled to serve 20 million service orders and return transactions annually across 110+ countries. This strategic move aligns with Accenture's ongoing efforts to expand its digital transformation, managed services, and sustainable supply chain solutions.

Another example is Jabil Inc.'s acquisition of Retronix in March 2023. Jabil's acquisition of Retronix brought several unique technology capabilities to the company, significantly enhancing its support for circular economy initiatives in electronics manufacturing.5 Retronix specializes services to refurbish integrated circuits (ICs) and printed circuit boards (PCBs) from data centers. This includes advanced laser reballing capabilities that don't expose components to reflow temperatures, preserving their integrity.6 These technologies enable Jabil to minimize electronic waste, create new value channels through component refurbishment and resale, mitigate future component obsolescence, and maintain high security, quality, and certification standards.

Scaling Through Platforms

A full two-thirds of the deals involve circular platforms. These highlight the opportunity to leverage scaling and network effects within the circular economy. One of the hottest areas has been the consolidation of apparel marketplaces. The recommerce market, particularly in apparel, is experiencing rapid growth and is expected to reach $350 billion globally by 2028, growing 3X faster than the overall global apparel market.7

Capturing this opportunity has spurred a host of deals—including Trove's acquisition of Recurate, Vinted's purchase of Trendsales, Naver's acquisition of Poshmark, GOAT's acquisition of Grailed, Vestiaire Collective's takeover of Tradesy, and Etsy's purchase of Depop—powerfully illustrate the strategic desire to capture growing recommerce opportunities in the apparel industry while driving market consolidation. The transactions also underscore the importance of digital platforms in facilitating recommerce, highlighting how resale-as-a-serve and platform business models are transforming traditional retail models and enabling more circular consumption patterns in the fashion industry.8

Classifieds are another area that has propelled deals. Take the example of CarGroup’s acquisition of Trader Interactive. An Australian online auto classifieds firm, CarGroup completed the acquisition of Trader Interactive in two stages, first taking a 49% stake in Trader Interactive in 2021, and the remaining stake the following year from Eurazeo SE and Goldman Sachs Asset Management—the total acquisition valued Trader Interactive at US$1,897 million. The acquisition significantly expanded its presence in the U.S. market and strengthened its position in the global online vehicle marketplace industry. Trader Interactive is a prominent online classifieds marketplace specializing in connecting buyers, sellers, and renters across multiple vehicle and equipment industries. The company operates 13 distinct classified websites across various industries websites that collectively reach over 13 million monthly unique visitors, providing digital platforms for diverse resale markets including powersports, recreational vehicles, commercial trucks, heavy equipment, and aviation.9

Growing Private Equity Plays

The acquisitions of Adevinta by Permira and Blackstone, and Nordic Capital's acquisition of Foxway, demonstrate a growing interest from private equity firms in circular economy businesses. This trend reflects the increasing importance of sustainability and resource efficiency in the global economy. Permira and Blackstone led a consortium that acquired Adevinta, a leading online classifieds business, for approximately $13 billion, highlighting private equity's interest in digital platforms that facilitate the resale and reuse of goods.10 Similarly, Nordic Capital acquired a majority stake in Foxway, a European provider of circular IT services, focusing on improving the sustainability of IT devices by increasing circularity across the value chain.11

These acquisitions target companies with business models that promote sustainability and resource efficiency, core principles of the circular economy. Private equity firms are recognizing the growth potential in circular economy businesses, driven by increasing consumer and corporate demand for sustainable solutions. The significant investment in Adevinta and the support for Foxway's international expansion indicate that private equity firms see opportunities to scale circular economy businesses globally. These investments suggest that private equity firms view circular economy businesses as having strong long-term value propositions, aligning with broader environmental and economic trends.

Acquisition and Retreat

Not all acquisitions work out. ThredUp's acquisition and subsequent divestment of Remix Global illustrates the challenges in the circular economy sector. ThredUp acquired Remix Global AD, a European fashion resale company, in July 2021 for $28.5 million. The acquisition was part of ThredUp's international expansion strategy, aiming to accelerate its growth in the European secondhand market, which was estimated to be $21 billion in 2020 and projected to grow to $39 billion by 2025.12

This expansion did not pan out as expected. In December 2024, ThredUp announced that it was divesting its European business. The decision came amid challenging market conditions for ThredUp. Following its IPO in 2021, the company's market capitalization dropped significantly, from an initial $1.3 billion valuation to as low as $60 million in November 2024.13

The divestment of Remix appears to be part of ThredUp's strategy to streamline operations and focus on its primary market in the face of these financial pressures. The sale of Remix was reported to be for $65.3 million, which is more than double the initial acquisition price. While this represents a financial gain for ThredUp, the divestment still marks a retreat from its European expansion plans, highlighting the challenges of growing through international acquisitions.

Conclusion

As these M&A deals illustrate, the circular economy is increasingly becoming a focal point for mergers and acquisitions. Companies are recognizing the immense potential for value creation within secondary markets, including the growing opportunities in reverse logistics, resale platforms, and circular data analytics. As businesses strive to enhance their operational capabilities and respond to various regulatory drivers, M&A activity in this sector will continue to grow.

We can expect that reverse logistics, circular eCommerce, and circular tech will continue to be attractive target areas in 2025. Major players in logistics are enhancing their service offerings to meet the growing demands of e-commerce, while circular tech firms are innovating to drive efficiency and new opportunities to generate circular revenue.14 Furthermore, the rise of platform-based business models is reshaping the resale landscape, enabling companies to capitalize on consumer interest in sustainable practices. It is increasingly clear that circular economy principles are not just for sustainability but have become drivers of business value and competitive advantage.

If your company is interested in learning more about circular M&A, please reach out to us at Capital Growth Partners at https://capitalgrowthpartners.net/

Footnotes