Amazon garners plenty of attention these days. One trend that gets less attention but is still noteworthy is the company’s voracious appetite for PhD economists. If we look this week, we will find a total of 31 positions open. Five of these roles are for directors and the remaining for mid-senior level economists. The majority are to be based in Seattle (75%) with the remaining spread across London, Arlington, Miami, San Diego, Culver City, and Shanghai. All of them require a PhD in economics or highly related field, such as operations research, machine learning, management science, or finance.

Here are the roles by seniority, location, job title and group they will be assigned when they join Amazon.

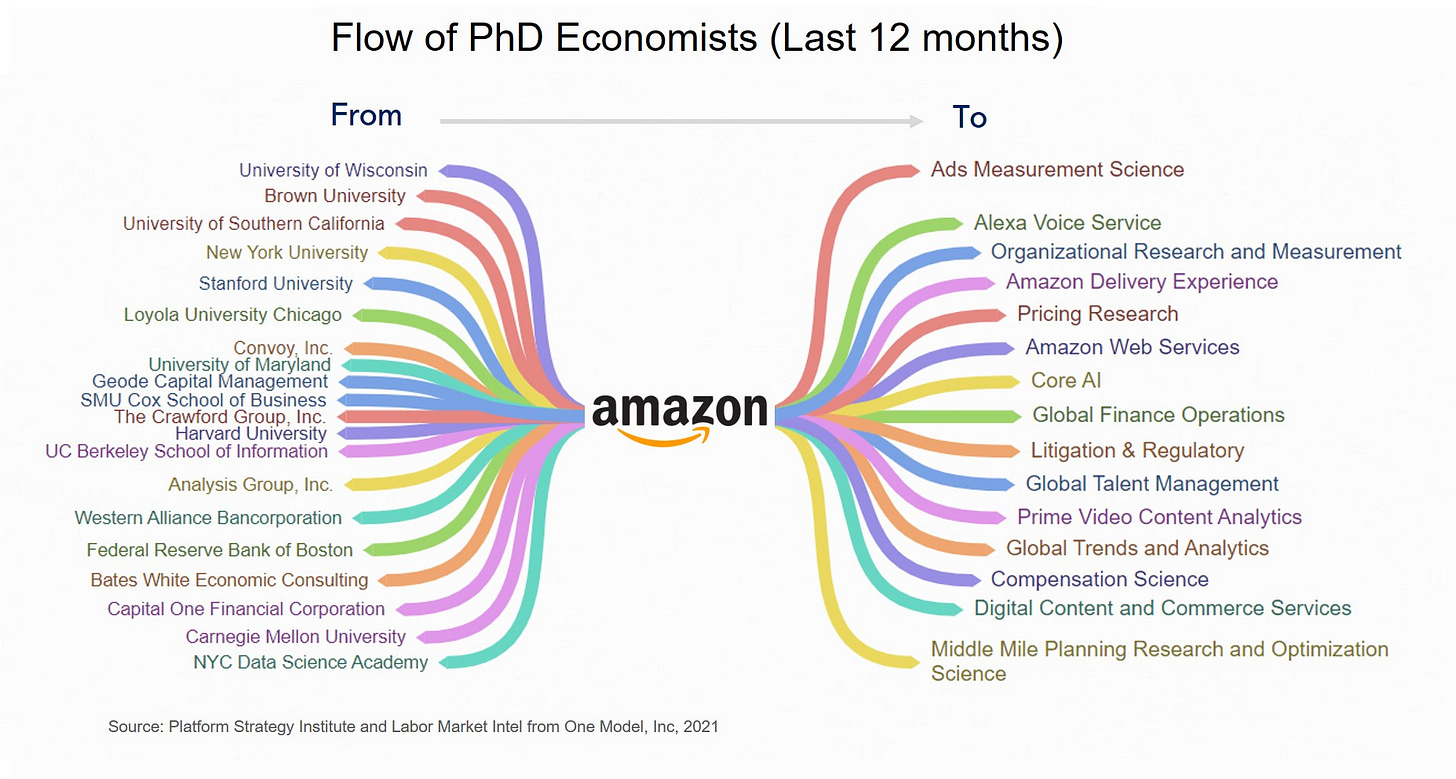

Where do they come from and where do they end up?

An indication of where the PhDs come from and where they land within Amazon can be seen from the flow of talent over the past year. Many come directly from University programs, often the top economics departments in the US, such as Harvard, Stanford, and the University of Wisconsin. Amazon also poaches talent from consulting firms, such as Bates White Economic Consulting, Convoy and Analysis Group as well as elite government organizations like the Federal Reserve.

Cost-benefit calculous

What does Amazon pay for all these PhDs? According to labor market intel from One Model, Inc., in the US alone there are over 250 PhD economists (or very closely related fields like business, operations research and finance) now employed at Amazon. If we assume an average base salary of $210K plus $90 in benefits and bonus, then the direct cost comes to a total of approximately $75 million annually.

The payoff of hiring a large group of econ PhDs is a bet that is hard to measure upfront. It is different from hiring the equivalent number of UI designers or software engineers. It is a more abstract, where the future value is not totally clear. The economists may do highly sophisticated analysis, but there is no guarantee that will return value back to the business. The bet could fail. Indeed, for most companies, the uncertainty about outcomes creates incentives to hold off investments off all types, especially large pools of untested talent. The normal inclination is to “test the waters” with a few hires and wait for validation that can be quantifed. You only have to look back a handful of years to the hiring of data scientists and how many of them ended up as sole operators within big businesses that didn’t have a clear idea of how to use or integrate them.

Another possibility is a very big win. Sure, these highly specialized economists may stumble at first in their new corporate environment. However, if they are embedded into a range of business units, solving a variety of problems, they will learn what matters most for the product lines and will likely spot new areas of potential value creation through analytics and insights. Their value to the business will grow. Within a year or two, they will gain proficiency in blending their economic inference and modeling toolkit with Amazon’s massive data sets a growing suite of best-in-class ML, AI and other analytic tools. In this case, the bet pays off big time.

The size of the talent pool matters. In companies with only one or two PhD economists, the opportunities for peer review are generally limited. When seeking peer inputs from others outside of the organization there will be limitations on information sharing and overall context. Within Amazon, this will not be the case because of the size of the economist community. Having a large and diverse set of sparring partners matters, especially when exploring new terrain and/or pushing the frontiers of applied methods. As in the marketplace for goods and services, Amazon is pushing for the exponential value of PhD researchers through scale.

With a community of PhD economists many times larger than Harvard University’s entire economics department, Amazon has created an environment where ideas have the potential to move quickly between collaborators of exceedingly high intellectual and problem solving capabilities. To drive meaningful results, it is also critical to effectively engage senior management on key business problems faced in retail, international retail, supply chain, traffic, search, pricing, cloud computing, third party merchants, and operations. The blend of advanced economics training and AI tools are applied to market design, pricing, forecasting, online advertising, supply chain network planning as well as other areas.

Pat Bajari, Chief Economist and Vice President of Amazon’s Core AI team, addressed some of the challenges and the potential payoff in a 2019 interview. See the video below:

The combination of a group of high-power humans working with high power analytic tools productivity and inference creates the opportunity for a kind of organizational superpower.

Add to this the the power of platform business models and you have quite a combination.

Studies suggest that combination works well together. Susan Athey, a professor at Stanford, who also spent time as an economist inside Microsoft, observed in a recent paper:

Multisided platforms are especially ripe for an economist’s skills, since these are exactly the kinds of settings in which it is critical to think through strategic behavior, interactions, and equilibrium effects. Bringing together their unique perspectives on assessing empirical relationships with their expertise in market design, economists offer particular value to technology firms by bringing together theory and data to predict not just the immediate effect of a decision, but how a decision affects equilibrium behavior in a market.

With 10 years of experience building up what is every likely the world’s largest private sector advanced economics talent pool, Amazon has had the opportunity to fine-tune its approach. For example, there are talented PhD economists that are interested in working for Amazon but do not want to leave their academic institutions. The Amazon Scholar program was set up to accommodate these cases by permitting academics to join Amazon “in a flexible capacity, in particular part-time arrangements and sabbaticals.” Also, some positions include an expectation that job seekers will publish in peer review journals. This may have little, if any, direct business value but as part of the job design, it can help to attract and retain PhDs who often want the opportunity (and support of their employers) to write papers and present at academic conferences. Few other companies do this.

So, what should we conclude from Amazon’s outsized appetite for PhD economists? A couple of things stand out. First, the company does not see AI as a technology but as an approach to solving business problems that requires highly (hyper?) trained researchers and thinkers at the helm. It sees the inference toolkit that an economist brings worth a sizable investment in payroll and organizational integration. Finally, scale matters. The bet in this intangible human capital is more likely to pay off with a battalion rather than a few snipers.

If Amazon is correct in how to really take advantage of data and AI, then it may have created a source of significant competitive advantage, since most other companies have few with this skillset, if any.

On Thursday, February 11th, Hamidreza Hosseini founder of Ecodynamics and I will present new data and insights on the world’s largest platform firms and the growing race for specialized platform talent. Join us for a data-rich discussion. Register for this international webinar for free here:

For a comprehensive analysis of the skills and experience that companies are seeking to advance their platform strategies see:

If you are not signed up yet and would like to keep recieving Platform Professional: